Boost your skills with Growth Memo’s weekly expert insights. Subscribe for free!

4 years after the DOJ lawsuit against Google started, Judge Amit Mehta declared Google guilty of monopolizing online search and advertising markets. The most successful startup in history is officially an illegal monopoly.

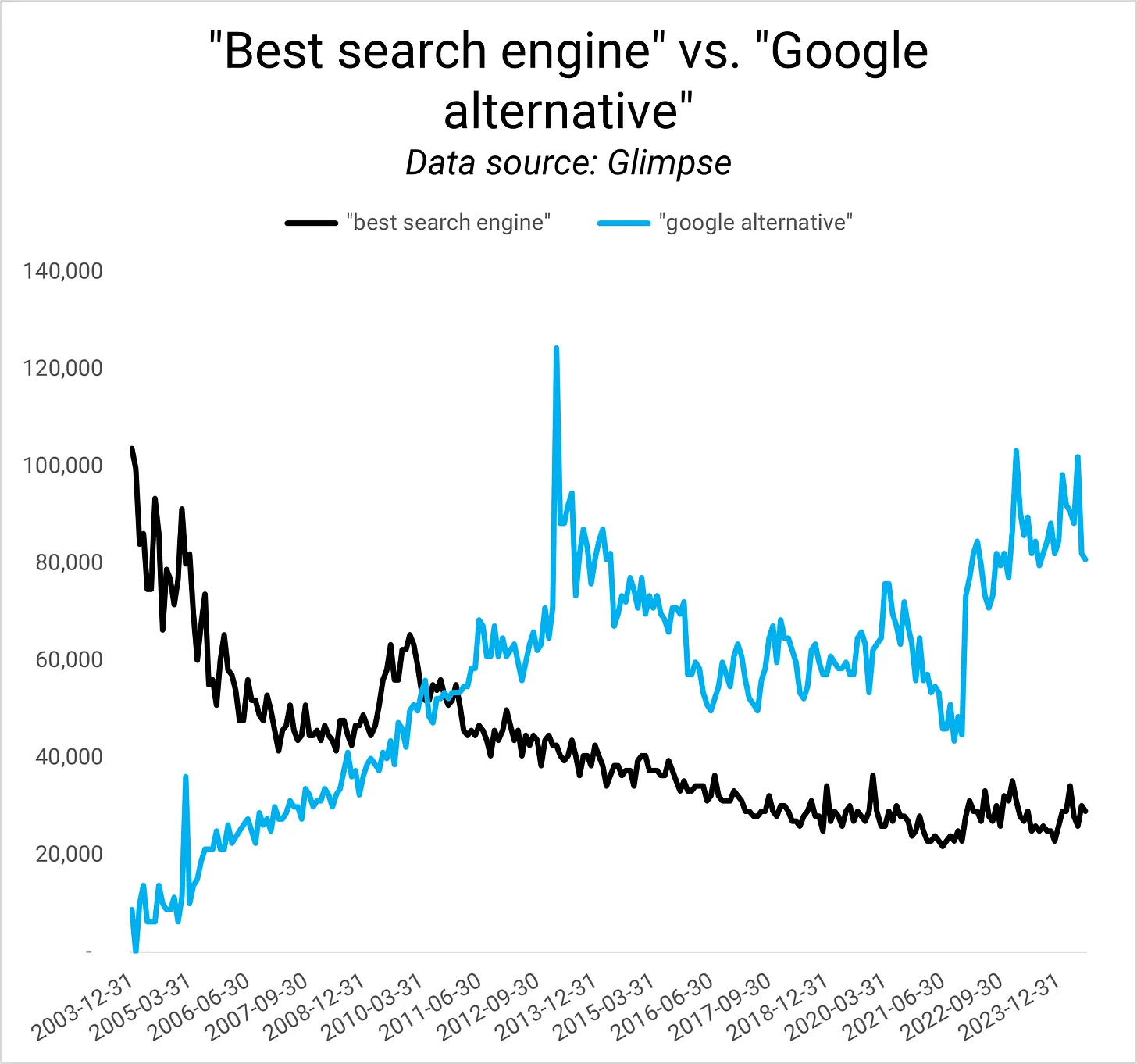

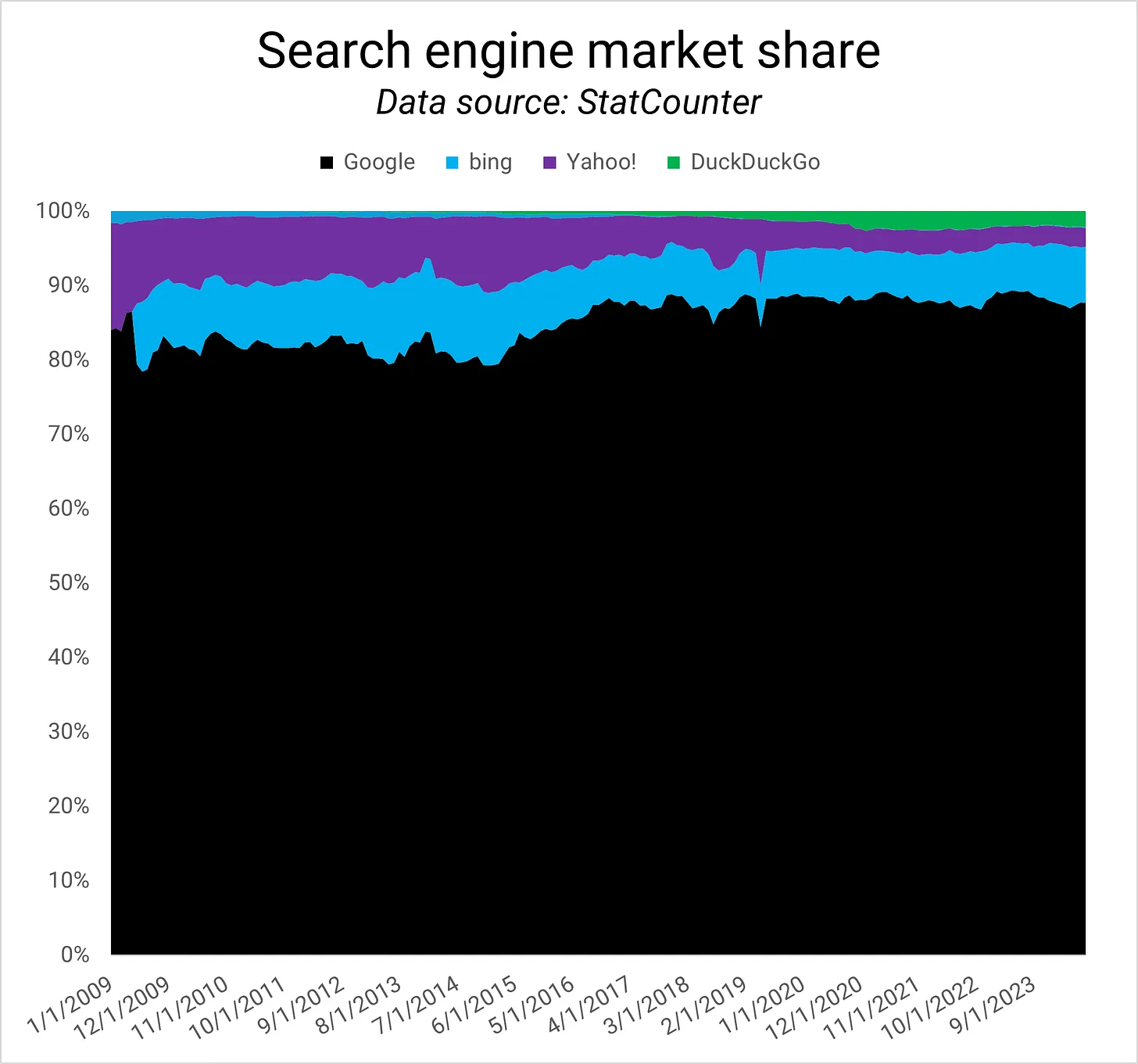

Google’s search engine market share (Image Credit: Kevin Indig).

Google’s search engine market share (Image Credit: Kevin Indig).The ruling itself is big, but the fat question in the room is what consequences follow and whether there is an impact on SEO.

I can’t look into the future, but I can run through scenarios. There is a good chance it will affect SEO and the open web.

Before we dive in, remember:

- I’m not a lawyer or legal expert.

- I solely rely on documents and insights from the court case for my opinion.

- When I refer to “the document”, I mean Judge Mehta’s opinion memorandum.1

Scenarios

Scenario planning is the art and science of envisioning multiple futures.

Step one is framing the key question: What might the remedies (consequences) of the lawsuit against Google be, and what potential consequences could result for SEO?

Step two is identifying the driving forces affecting the key question:

- Legal:

- Judge Mehta concludes that Google is an illegal search monopoly, not an advertising monopoly. This is important.

- The defining precedent lawsuit against Microsoft in the 90s didn’t lead to a break-up of the company but the opening of APIs, sharing of key information and a change in business practices.

- Economic:

- Google faces competition in advertising from Amazon, TikTok and Meta.

- Google has superior market share in search, browsers, mobile OS and other markets.

- Exclusivity and revenue share agreements between Google, Apple, Samsung, Mozilla and other partners delivered massive traffic to Google and profits to partners.

- Technological:

- Apple agreed not to innovate in search, spotlight and device search in return for revenue share.

- Large Language Models are in the process of changing how search works and the dynamics between searchers, search engines and content providers.

- Social: Younger generations use TikTok to search and social networks to get news and other information.

- Political:

- The sentiment of “big tech” has turned largely negative.

- After almost two decades of no anti-competitive action against tech companies, the Google lawsuit could start a wave of tech regulation.

Step three is defining scenarios based on the key question and driving forces. I see 3 possible scenarios: